Top Guidelines Of Hard Money Georgia

Wiki Article

All about Hard Money Georgia

Table of ContentsHard Money Georgia for DummiesWhat Does Hard Money Georgia Mean?The 10-Minute Rule for Hard Money GeorgiaHard Money Georgia Things To Know Before You Buy

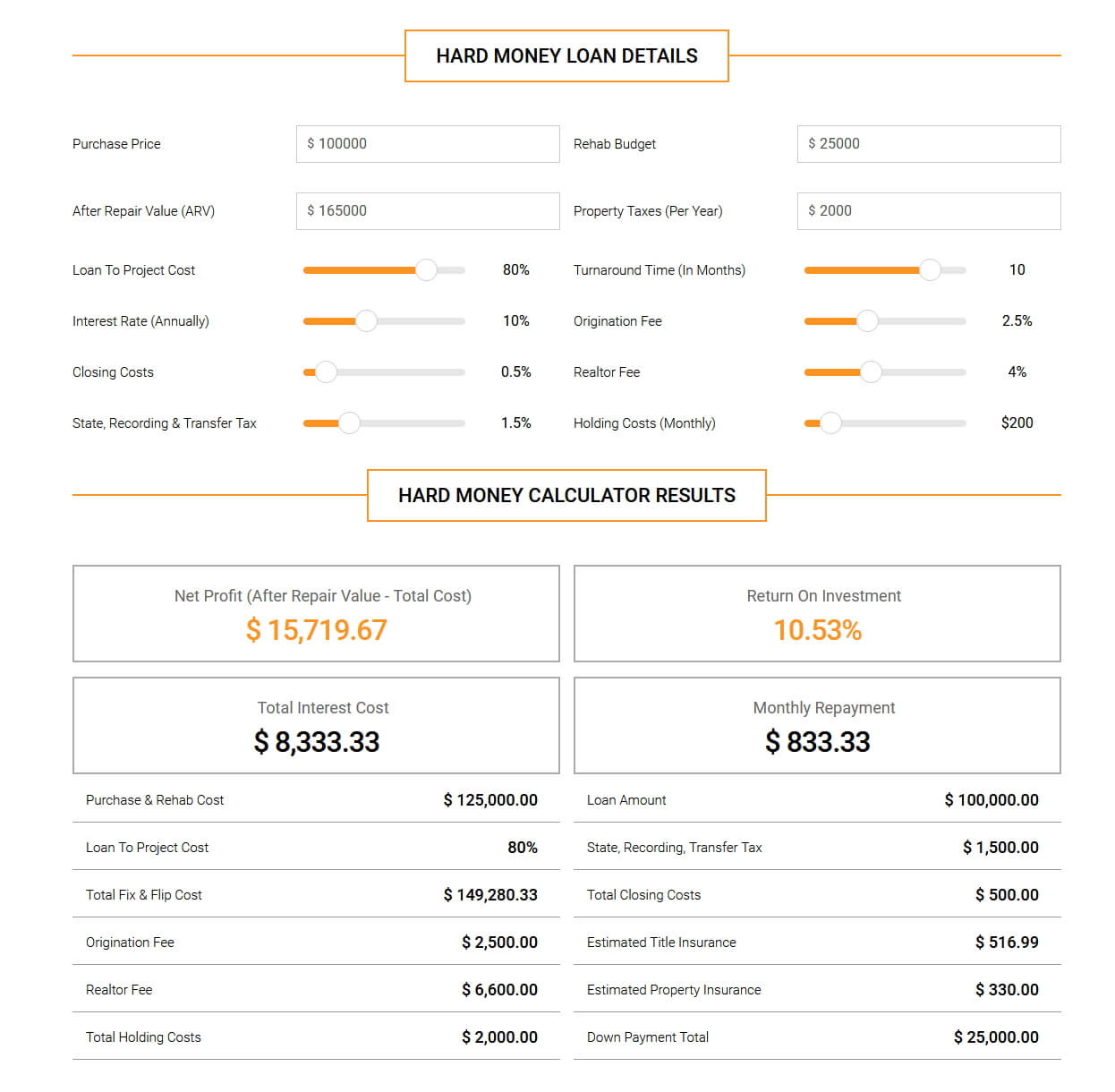

The maximum appropriate LTV for a tough money finance is generally 65% to 75%. That's how much of the building's expense the loan provider will be prepared to cover. As an example, on a $200,000 residence, the maximum a hard money loan provider would agree to provide you is $150,000. To acquire the residential or commercial property, you'll have to think of a deposit huge sufficient to cover the remainder of the acquisition price.

By contrast, interest rates on difficult money finances begin at 6. Tough cash lending institutions often charge factors on your lending, in some cases referred to as origination fees.

Points are generally 2% to 3% of the funding amount. 3 factors on a $200,000 financing would certainly be 3%, or $6,000. hard money georgia. You might have to pay more points if your loan has a greater LTV or if there are numerous brokers entailed in the deal. Some loan providers charge just factors and no other costs, others have extra costs such as underwriting costs.

The Hard Money Georgia Ideas

You can expect to pay anywhere from $500 to $2,500 in underwriting fees. Some hard cash loan providers additionally charge prepayment fines, as they make their money off the passion costs you pay them. That indicates if you repay the finance early, you might have to pay an extra charge, contributing to the loan's cost.This implies you're most likely to be used financing than if you used for a typical home mortgage with a doubtful or slim credit background. If you need cash swiftly for restorations to flip a house for revenue, a difficult cash financing can offer you the cash you require without the inconvenience as well as paperwork of a typical home mortgage.

It's an approach investors use to get investments such as rental buildings without utilizing a lot of their own possessions, and also hard cash can be useful in these situations. Difficult cash finances can be valuable for genuine estate investors, they should be utilized with caution especially if you're a novice to genuine estate investing.

With shorter payment terms, your monthly settlements will certainly be far much more expensive than with a regular home mortgage. Finally, if you fail on your funding settlements with a hard cash lending institution, the consequences can be serious. Some loans are personally guaranteed so it can harm your credit rating. As well as because the lending is safeguarded by the building in inquiry, the lending institution can take possession as well as confiscate on the residential property since it functions as security.

Some Known Details About Hard Money Georgia

To find a trustworthy loan provider, speak with relied on property representatives or home visit this web-site loan brokers. They may have the ability to refer you to loan providers they've dealt with in the past. Hard money loan providers additionally frequently go to actual estate financier conferences to make sure that can be a great location to get in touch with lenders near you.Equity is the value of the building minus what you still owe on the home loan. Like tough cash car loans, residence equity financings are secured financial debt, which means your building functions as collateral. Nonetheless, the underwriting for home equity finances additionally takes your credit rating history and also earnings right into account so they have a tendency to have reduced rates of interest and longer payment periods.

When it pertains to funding their following offer, actual estate financiers as well as entrepreneurs are privy to numerous lending alternatives virtually made for property. Each comes with particular requirements to gain access to, and if made use of appropriately, can be of massive benefit to investors. Among over at this website these financing kinds is difficult money borrowing.

It can also be called an asset-based funding or a STABBL car loan (temporary asset-backed swing loan) or a bridge loan. These are stemmed from its particular short-term nature and also the demand for tangible, physical collateral, normally in the kind of actual estate property. A difficult cash loan is a funding kind that is backed by or secured making use of a real estate.

webpage

7 Simple Techniques For Hard Money Georgia

In the very same vein, the non-conforming nature affords the loan providers an opportunity to choose their own specific demands. Consequently, demands may differ considerably from lending institution to lending institution. If you are seeking a loan for the initial time, the authorization process might be reasonably strict and also you might be required to provide additional info.

This is why they are primarily accessed by actual estate business owners that would usually require fast funding in order to not miss out on warm opportunities. On top of that, the lender primarily takes into consideration the value of the asset or home to be purchased as opposed to the consumer's personal finance background such as credit report or revenue.

A standard or small business loan may occupy to 45 days to close while a tough cash finance can be enclosed 7 to 10 days, sometimes earlier. The benefit and speed that difficult cash lendings supply continue to be a major driving force for why actual estate investors pick to use them.

Report this wiki page